February sales in the Greater Toronto Area (GTA) were down substantially from the pre-rate hike levels of early 2022. However, the number of new listings also dropped substantially year-over-year. The result was that the average selling price and MLS® HPI continued to level off after trending lower through the spring and summer of last year.

“It has been almost a year since the Bank of Canada started raising interest rates. Home prices have dropped over the last year from the record peak in February 2022, mitigating the impact of higher borrowing costs. Many homebuyers have also decided to purchase a lower priced home to help offset higher borrowing costs. The share of home purchases below one million dollars is up substantially compared to this time last year,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

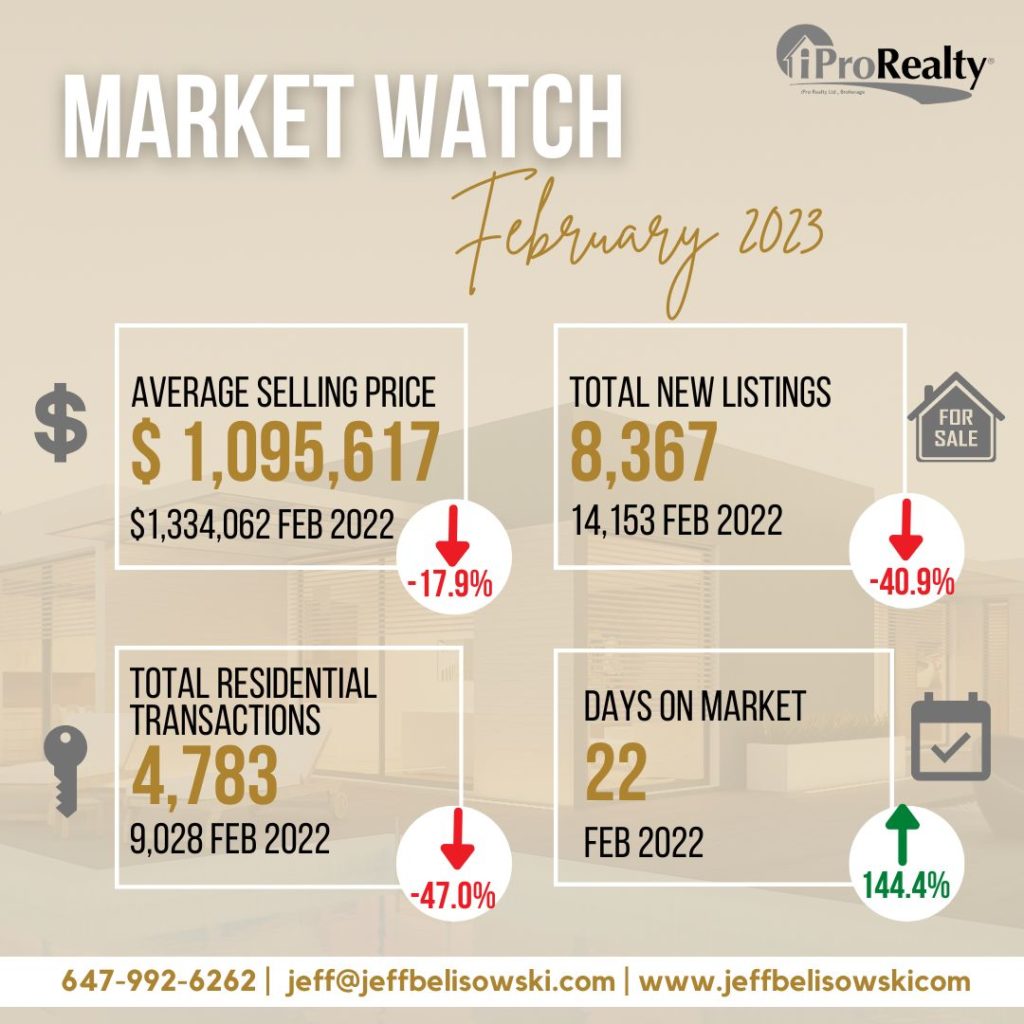

GTA REALTORS® reported 4,783 sales through TRREB’s MLS® System in February 2023 – down 47 per cent compared to February 2022, the last full month before the onset of interest rate hikes. The number of new listings entered into the system was down by a similar annual rate of 40.9 per cent to 8,367.

“New listings continued to drop year-over-year in the GTA. Recently released Ipsos polling suggests buying intentions have picked up for 2023. This increased demand will run up against a constrained supply of listings and lead to increased competition between buyers. This will eventually lead to renewed price growth in many segments of the market, especially those catering to first-time buyers facing increased rental costs,” said TRREB Chief Market Analyst Jason Mercer.

The average selling price for February 2023 was $1,095,617 – down 17.9 per cent compared to February 2022. Some of this decline is attributable to the fact that the share of sales below $1,000,000 was 57 per cent in February 2023 versus only 38 per cent a year earlier. On a monthly basis, the average price followed the regular seasonal trend, increasing relative to January 2023. The MLS® Home Price Index (HPI) Composite Benchmark was down year-over-year by a similar annual rate of 17.7 per cent, but was also up on a monthly basis.

“As we move toward a June mayoral by-election in Toronto, housing supply will once again be front and centre in the policy debate. New and innovative solutions, including the City of Toronto’s initiative to allow duplexes, triplexes and fourplexes in all neighbourhoods citywide, need to come to fruition if we are to achieve an adequate and diverse housing supply that will support record population growth in the years to come,” said TRREB Chief Executive Officer John DiMichele.

Read the full report here: https://buff.ly/3EPnuC3

Jeff Belisowski

Sales Representative

iPro Realty Ltd., Brokerage

Cell: 647-992-6262

Email: jeff@jeffbelisowski

-

NEW LISTING ALERT! 315 – 3121 SHEPPARD AVENUE E, Toronto

🚨 NEW LISTING ALERT! 315 – 3121 SHEPPARD AVENUE E, Toronto, ON [MLS# E9039425] Let your dreams come true at Wish Condos! Located at Sheppard and Pharmacy, this bright and spacious open concept 1 Bedroom + Den is nearly 600 sqft with a 40 sqft open balcony offering a great view. Enjoy 9 ft ceilings…

-

Market Statistics – June 2024

June 2024 home sales in the Greater Toronto Area (GTA) were lower compared to the same month last year, according to the Toronto Regional Real Estate Board (TRREB). Despite the Bank of Canada rate cut at the beginning of last month, many buyers kept their home purchase decisions on hold. The market remained well-supplied, resulting…